IPROBET เว็บไซต์ แทงบอลออนไลน์ คาสิโนออนไลน์ บาคาร่าออนไลน์ อันดับหนึ่ง

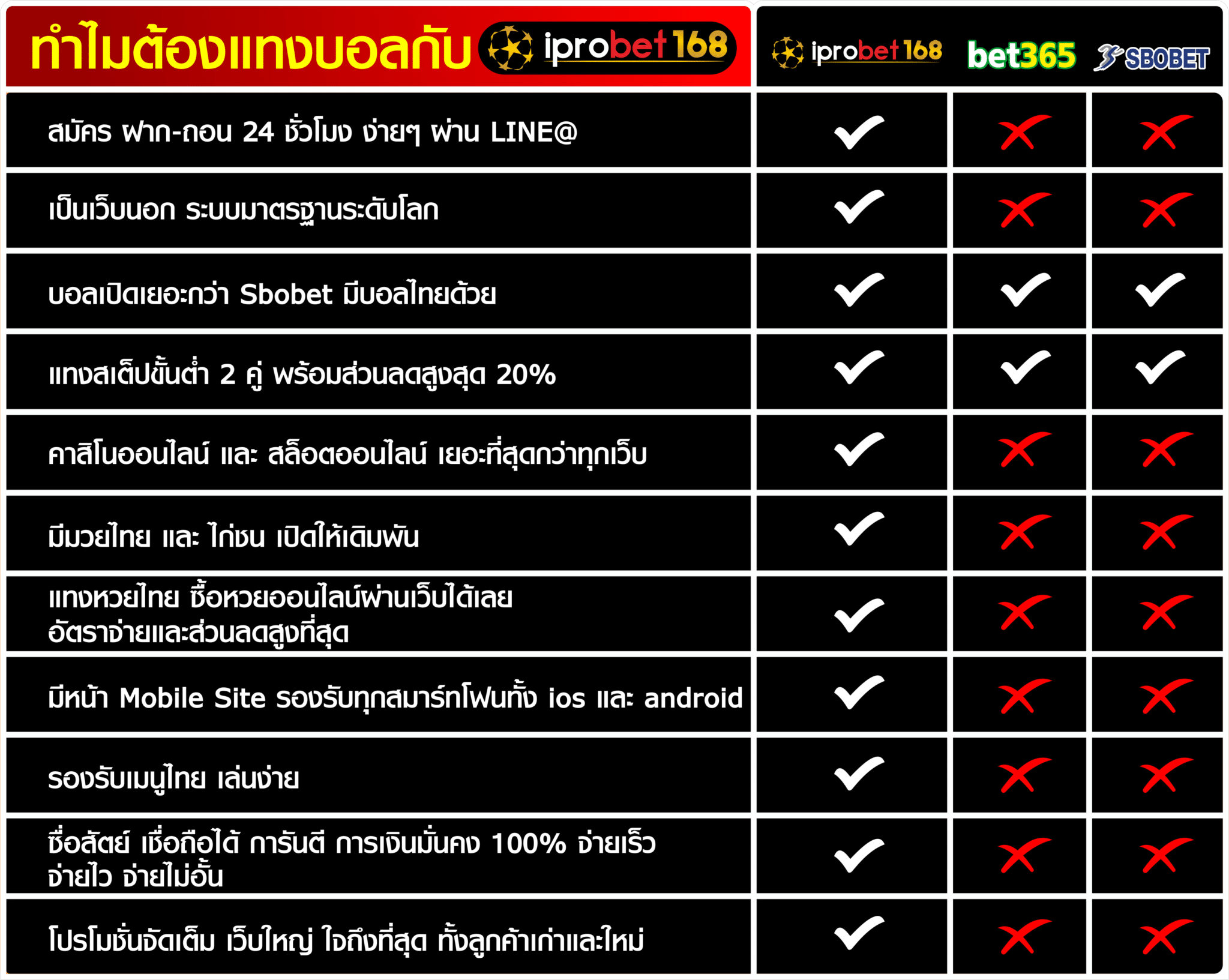

IPRO168.COM คือเว็บไซต์ที่ให้บริการของ IPROBET แทงบอลออนไลน์ แทงบอล คาสิโนออนไลน์ ครบวงจร ที่มีความมั่นคง 100% เป็นเว็บเดิมพันฟุตบอลที่ดีที่สุด ของเราจะมีทั้ง บอล หวย มวย คาสิโน สล็อตออนไลน์ ป๊อกเด้งออนไลน์ เว็บแทงบอลออนไลน์ ประจำประเทศไทย ที่ให้บริการอย่างครบถ้วน บริการดีเยี่ยม ตลอด 24 ชั่วโมง เปิดระบบออนไลน์สำหรับลูกค้าทุกท่านที่ต้องการจะ แทงบอลผ่านเว็บ BET ตอบสนองตามความต้องการของคนไทย เปิดให้ เดิมพันออนไลน์ ทุกลีกดัง ครบทุกคู่ที่ต้องการจะเล่น ขั้นต่ำเริ่มต้นสำหรับ แทงบอลสเต็ป แทงมวยสเต็ป เพียง 10 บาทเท่นนั้น สำหรับ แทงบอลเดี่ยว หรือ แทงบอลเต็ง ขั้นต่ำเพียง 20 บาท เป็นการเริ่มต้นการลงทุนที่ลงทุนน้อย แต่ได้ผลกำไรงามอย่างมาก เข้าถึงความรู้สึกของนักเล่นทั้งหน้าใหม่และเก่า นอกจากยังเป็น เว็บแทงบอล แล้ว ยังเป็น เว็บ คาสิโนออนไลน์ ที่เปิดบริการครบทุกรูปแบบของการเล่น ทั้ง บาคาร่าออนไลน์ รูเล็ต เล่นได้ตลอดเวลา เข้าถึงได้จากทุกๆ อุปกรณ์ แทงบอลมือถือ ก็สามารถเล่นผ่านเว็บของเราได้ สะดวก รวดเร็ว ปลอดภัย นั้นคือ สิ่งที่เรายึดถือปฏิบัติกันเสมอมา และ เรามุ่งเน้นไปที่เรื่องของการบริการและ โปรโมชั่น ที่จะเอื้อต่อการเล่นของท่าน ให้ท่านได้ประโยชน์จากการเล่นผ่านเว็บของเรามากที่สุด เปิดให้สมาชิกสมัครใช้บริการที่ IPROBET ที่เป็นเว็บตรง ไม่ผ่านเอเย่นต์ สมาชิกสามารถฝาก – ถอนกับเราได้ตลอด รวดเร็วและมั่นคง จนนักพนันหลายต่อหลายคนเลือกที่จะใช้บริการกับเราเว็บ แทงบอลออนไลน์ ที่ดีที่สุด svalyava.org

IPRO168.com สะดวกสบาย มั่นคง รวดเร็ว ปลอดภัย

การฝาก-ถอน รับประกันไม่เกิน 3 วิ ด้วยระบบอัตโนมัติ ระบบรองรับการใช้งานง่ายผ่านคอมพิวเตอร์ และสมาทโฟนใช้เวลาไม่กี่นาที ก็สามารถเข้าเล่นเว็บพนันออนไลน์ได้อย่างง่ายดายและยัง รองรับมาตฐานสากลโลก

เพื่อให้ท่านได้รับประสบการณ์ที่มีคุณภาพสูงสุดท่าที่ท่านเคยจะได้รับจากเว็บอื่น ๆ เรายินดียอมรับคำติชมจากท่านเราและแก้ไขปรับปรุงคุณภาพเว็บของเราให้เป็นชั้นนำ ไม่ว่าจะเป็นเรื่อง เกม สล็อต คาสิโน เกมยิงปลา ป๊อกเด้งออนไลน์ ตีไก่สามกอน น้ำเต้าปูปลา หรือเรื่องต่าง ๆเราคืออันดับหนึ่งในด้านการให้บริการคอยเทคแคร์ลูกค้าทุกท่าน ตอบแชทกลับภายใน 30 วิ สามารถปรึกษาหรือสอบถามปัญหาผ่านแอดมินได้โดยตรงตลอด 24 ชม.

เว็บไซต์แทงบอลออนไลน์ พนันออนไลน์ เล่นคาสิโน บาคาร่า รูเล็ต แทงบอลเดี่ยว บอลสเต็ป แทงบอลเบทคลิก เราคือตัวแทนโดยตรงไม่ผ่านเอเย่นต์ ผู้นำด้านบริการเกมส์พนันออนไลน์มาตรฐานสากล เปิดให้บริการทั้ง แทงบอล แทงฟุตบอล แทงพนันกีฬาออนไลน์ คาสิโนออนไลน์ทุกรูปแบบ คาสิโน รวมทั้งยังมีเกมส์สล็อตออนไลน์ สำหรับผู้ที่ชื่นชอบการเล่นเกมส์ออนไลน์ต่างๆ แทงหวย หวยออนไลน์ เล่นได้ทั้งคอมพิวเตอร์ และมือถือ รองรับทั้งระบบ IOS และ Android เว็บไซต์เรามีระบบที่เป็นมาตรฐานของระบบการเล่นพนัน ออกราคายุติธรรม อัพเดตราคาตลอดเวลา การันตีค่าน้ำดีที่สุด

ทางเข้าเล่น Ipro168

สมัครสมาชิกใหม่ ฝาก ถอน ตลอด 24 ชั่วโมง มีทีมงานมืออาชีพค่อยให้บริการ และเป็นที่ปรึกษาแก่ลูกค้าทุกท่าน ไม่ว่าจะปัญหาการเข้าเล่น การฝาก-ถอนเงิน ด้วยระบบอัตโนมัติ หรือวิธีการเล่นต่างๆ เว็บเราก็มีข้อมูลอธิบายให้อย่างครบถ้วน พร้อมโปรโมชั่นจัดเต็มทั้งลูกค้าเก่าและใหม่

- ทางเข้าIPROBET : https://svalyava.org

- ทางเข้าแทงบอล : https://svalyava.org

- ทางเข้าบาคาร่า : https://svalyava.org

- ทางเข้าป๊อกเด้งออนไลน์ : https://svalyava.org

สล็อต เว็บสล็อต สล็อตออนไลน์ สล็อตแตกง่าย SLOTEXP เทคนิคปั่นสล็อตให้ได้รางวัลใหญ่

สล็อต SLOTEXP หากจากจะพูดถึง เกม สล็อตออนไลน์ ในชั่วโมงนี้ เชื่อได้เลยว่าคงจไม่มี ใครไม่รู้จัก SLOTXD อย่างแน่นอน เพราะถือว่า เป็นเกมพนันออนไลน์ยอดนิยม ที่เล่นง่าย ไม่มีกติกา ที่ยุ่งยาก อีกทั้ง ยังมีค่าตอบแทนที่สูง จึงทำให้เหมาะสำหรับ นักพนันมือใหม่ ที่พึ่งหัดเล่น ตลอดจนผู้ที่ต้องการ จะหารายได้จากการพนันออนไลน์ แต่ยังไม่มีทักษะในการเล่นพนันประเภทอื่นมากนัก ดังนั้น SLOTXO ออนไลน์ ก็ถือเป็นอีกหนึ่ง ตัวเลือกที่ดีที่สุด สำหรับผู้ที่มีใจรัก ในการเสี่ยงโชคทุกคน

เว็บสล็อต ความสะดวกสบาย เป็นข้อได้เปรียบหลัก สำหรับผู้ชื่นชอบเกม สล็อต ทุกคน เนื่องจากสามารถเข้าถึงได้ทางออนไลน์ ผู้เล่นจะได้รับการช่วยเหลือ จากความสำคัญในการเยี่ยมชมคาสิโน ที่อยู่ห่างไกลออกไป เพียงเพื่อเพลิดเพลิน กับ เว็บสล็อต ที่ผู้เล่นเป็นคนเลือก เนื่องจากขณะนี้ เกมออนไลน์สามารถเข้าถึงได้บนอุปกรณ์พกพา จึงสามารถเล่นได้ทุกที่ทุกเวลา ตามที่ผู้เล่นมีความปรารถนา

สล็อต น่าเล่นอย่างไร ทำไมต้องเลือกเดิมพัน สล็อตออนไลน์

การเล่น สล็อต นั้น นอกจากเงินรางวัลแล้ว ยังมีปัจจัยด้านอื่นๆอีก ที่ผู้เล่นอาจจะยังไม่รู้ ซึ่งจะพูดถึงเหตุผล ในการเลือกเล่นสล็อตออนไลน์ นับว่าเป็นอีกหนึ่งสิ่ง ที่ผู้เล่นสามารถสร้างรายได้ จากการเล่นเกมสล็อนออนไลน์ ซึ่งเกมสล็อตออนไลน์นั้น มีวิธีการเล่นง่ายแสนง่าย อีกทั้งยังไม่ต้องเดินทางไปเล่นตามตู้สล็อต หรือ แหล่ง สล็อตคาสิโน ต่างๆเหมือนสมัยก่อนอีกด้วย หนึ่งเหตุผล ที่ควรเล่น สล็อตออนไลน์ คือ ผู้เล่นไม่จำเป็นจะต้องเดินทางไปเล่นสล็อตไกลๆ ไม่เสียเวลา อีกทั้ง จะเลือกเล่นช่วงเวลาไหน ก็ง่าย และ สะดวกสบาย เท่านั้นยังไม่พอ ผู้เล่นยังประหยัดงบประมาณในการเล่น แต่ได้เงินรางวัลตอบแทนสูงอีกด้วย เพราะ เมื่อผู้เล่นเข้าเล่นในเว็บพนันออนไลน์ ส่วนใหญ่แล้ว มักจะมีการให้เครดิตฟรี ซึ่งนั่น จะเป็นผลดีกับผู้เล่นอย่างมาก และ ไม่ต้องกังวลเลยว่าจะโดนโกงหรือไม่ เพราะ สล็อตเว็บตรง เว็บพนันที่น่าเชื่อถือ ในปัจจุบันนี้ จะมีผู้ดูแล ที่มีความชำนาญ และ เป็นผู้เชี่ยวชาญคอยตอบคำถาม รวมถึงดูแลระบบเว็บไซต์เป็นอย่างดี ไม่เท่านั้น หากเล่น สล็อตออนไลน์ไม่มีขั้นต่ำ แล้วกังวลว่า จะไม่ชอบเกมที่ตนเองเลือก ไม่ต้องห่วงเรื่องนี้ไปเลย เพราะว่า ในเว็บไซต์ออนไลน์ ก่อนที่ผู้เล่นจะเล่นจริงจัง ระบบจะมีเกม สล็อตทดลองเล่น ให้ก่อนเสมอเพื่อให้ผู้เล่น ได้เรียนรู้กับเกมนั้น มากยิ่งขึ้น ที่สำคัญ จะเล่นกี่เกมก็ได้ โดยที่ยังไม่ต้องเสียค่าใช้จ่าย ในระหว่างที่กำลังทดลองเล่น และ มีโอกาสได้พัฒนาฝีมือมากขึ้นไปเรื่อยนั่นเอง

เว็บสล็อต ที่มีผู้เล่นมากที่สุด ดีอย่างไร

ปัจจุบันนี้ เว็บสล็อต มีอยู่มากมายเต็มไปหมด แต่ทุกคนรู้หรือไม่ว่า ความน่าเชื่อถือในแต่ละเว็บนั้น มีไม่เท่ากัน ล้วนมีทั้งเว็บที่ เชื่อถือได้ และ เชื่อถือไม่ได้ ดังนั้นจำนวนผู้เล่นจึงเป็นสิ่งที่สำคัญ เพราะจะบ่งบอกได้ว่า เว็บนั้นเป็น เว็บสล็อตที่ดีที่สุด หรือไม่ เพราะถ้ามีผู้เล่นที่เยอะก็จะเป็นเครื่องยืนยัน ได้เป็นอย่างดีว่า เว็บสล็อตมีความน่าเชื่อถือ และ สามารถเล่นได้ นอกจากนี้ยังมีเครื่องยืนยัน อีกหลากหลายรูปแบบ แต่หลักๆก็คือ จำนวนของผู้เล่นนี้แหละ ลองคิดดูสิว่าถ้ามีเว็บสล็อตที่มีโปรโมชั่นดีมาก ล่อตาให้เราไปเล่น แต่พอลองเข้าไปดูแล้ว พบว่าเว็บนั้นแถบจะไม่มีผู้เล่นเลย คุณจะกล้าเล่นไหม เห็นไหมว่าจำนวนผู้เล่น ถือเป็นสิ่งสำคัญมาก นอกจากนี้ จำนวนของผู้เล่น ยังบ่งบอกได้อีกหลายเรื่อง ไม่ว่าจะเป็น อัตราการจ่ายเงินรางวัล ว่ามีความคุ้มค่าที่จะเสี่ยงเล่นไหม หรือ คุณภาพของเว็บสล็อตนั้นๆว่าดีหรือป่าว

สล็อ คืออะไร ทำไมนักพนันชื่นชอบ

สล็อ หลายๆคนอาจจะยังไม่รู้ ว่าสล็อต คืออะไร สล็อ คือเกมการพนันรูปแบบหนึ่ง ที่เมื่อก่อนมีชื่อเรียกกันว่า สล็อตแมชชีน ปัจจุบัน สล็อต มีระบบที่สามารถเล่นได้ผ่านออนไลน์ หรือที่เรียกกันว่า สล็อตออนไลน์ และ เหล่านักพนันออนไลน์นั้น ต่างชื่นชอบเกมสล็อตออนไลน์ กันเป็นอย่างมาก เพราะว่า เกมสล็อตแต่เดิม เป็นเกมที่เล่นได้ง่ายอยู่แล้ว และ ยิ่งเข้ามาเป็นแบบออนไลน์ ทำให้ยิ่งเพิ่มความง่าย ในการเล่นเข้าไปใหญ่ และ แน่นอน เพียงเหตุผลแค่นี้ไม่สามารถทำให้ ผู้เล่นชื่นชอบได้ขนาดนั้น แต่อีกหนึ่งอย่างที่ ผู้เล่นชื่นชอบ คือ สล็อตโบนัสแตกจริง แบบไม่มีกัก ทำให้ผู้เล่นติดเกมนี้กันอย่างหนาแน่น เพราะนอกจากจะเล่นง่ายแล้ว ยังเป็นเกมที่ ทำเงินทำกำไร เข้ากระเป๋านักพนันกันอย่างง่ายดาย ไม่ว่าใครก็สามารถที่จะเล่นเกมนี้ได้ รวมไปถึงผู้เล่นหน้าใหม่ด้วย ที่นี้รู้แล้วใช่ไหมว่า สล็อตดีอย่างไร ทำไมนักพนันถึงชื่นชอบกันนัก

สูตรสล็อต คืออะไรเชื่อถือได้หรือไม่ ?

สูตรสล็อต เชื่อได้เลยว่าคำที่เหล่านักพนันมากมาย ค้นหาคำตอบมากที่สุด คงจะหนีไม่พ้นคำนี้ อย่างแน่นอน เพราะเนื่องด้วย เกมสล็อตออนไลน์ กำลังเป็นที่นิยมเป็นอย่างมาก ในหมู่นักพนัน และ ถ้าหากอยากที่จะเล่นให้เก่ง เล่นให้รวย ทุกคนต้องการเทคนิค หรือ สูตรการเล่นกันทั้งนั้น แต่ด้วยเกมสล็อตเป็นเกมที่คนให้ความสนใจมาก จึงทำให้ มีผู้เขียนถึงเรื่องพวกนี้ กันเป็นจำนวนมาก ไม่ว่าจะเป็น สูตรสล็อตรวยแน่นอน หรือจะเป็น สูตรสล็อตเล่นยังไงให้รวย และอื่นๆ อีกมากมาย แน่นอนว่า ล้วนมีทั้งอันที่เชื่อถือได้ และ เชื่อถือไม่ได้กันทั้งนั้น เพราะฉะนั้นแล้ว เราควรที่จะศึกษาให้ดี ว่าอันไหนจริง อันไหนหลอก ทางที่ดีเลยก็คือ เราควรที่จะ ทดลองเล่นด้วยตัวเอง โดยเริ่มจากการลงทุนที่ต่ำๆ เพื่อทำการศึกษาก่อนก็ได้ แล้วเราจะรู้เลยว่า ควรทำอะไร ไม่ควรทำอะไร เรียกได้ว่า เป็น สูตรสล็อตของตัวเอง เลยก็ว่าได้

สล็อตวอลเลท เล่นง่าย ถอนไว ไม่เสียค่าบริการ

หลายๆคนที่ประสบปัญหาชื่นชอบ การเล่นเกมการพนันออนไลน์ แต่ติดปัญหาเรื่องการฝาก-ถอน ที่ยุ่งยากต้อง ผ่านบัญชีธนาคาร และ วิธีการที่ซับซ้อน วันนี้เรามาเอาใจนักพนัน ที่ชื่นชอบการเล่น แต่ประสบปัญหา ฝาก-ถอน ด้วย สล็อตวอลเลทฝาก-ถอน ไม่มีขั้นต่ำ แค่มีแอปพลิเคชั่น ทรูมันนี่วอลเล็ท ก็สามารถเพิ่มความสะดวกสบาย ให้กับทุกคนได้เป็นอย่างมาก ด้วย การฝาก-ถอน แบบ อัตโนมัติ แถมยังเพิ่มความสะดวกไปให้ผู้เล่นอีกระดับด้วย สล็อตวอลเลทฝากฟรีไม่เสียค่าบริการ ทำให้ผู้เล่นวางใจไปได้เลย ถึงเรื่องการเสียเม็ดเงินฟรีๆ นอกจากนี้ ด้วยความร่วมมือกันครั้งนี้ ของ สล็อต และ แอปพลิเคชั่น ทรูมันนี่วอลเล็ท ทำให้ สล็อตวอลเล็ทแจกโบนัส ไปให้ผู้เล่นอีกฟรีๆ ให้ผู้เล่นนำไปต่อยอดในเกม เพื่อเพิ่มพูนกำไร ให้มากยิ่งขึ้น เพราะ เกมของเรานั้นบอกได้เลยว่า ยิ่งเล่นยิ่งมีสิทธิ์รวย

สล็อตวอเลท ตอบโจทย์ ทุกการบริการ

หลายคนอาจจะกำลังสงสัยว่า สล็อตวอเลท คืออะไร สล็อตวอเลท คือ สิ่งที่จะอำนวยความสะดวก ให้กับทุกท่าน ในทุกๆช่องทาง ใครที่ประสบปัญหาการ ฝาก-ถอน สล็อตวอเลท ฝาก-ถอน ฟรี ช่วยคุณได้ หรือว่าใครที่ ประสบปัญหา ติดขัดอะไรในการเล่น หรือ การใช้จ่ายเงิน บอกได้เลยว่า สล็อตวอเลทช่วยคุณได้ เพราะสล็อตวอเลท เป็นช่องทางการทำธุรกรรมทางการเงินได้อย่างอิสระ แถมยัง รวดเร็ว ปลอดภัย ไว้ใจได้ เพราะทุกคนก็รู้ดีอยู่แล้วใช่ไหมว่า แอปพลิเคชั่น ทรูมันนี่วอลเล็ท โด่งดัง และ มีชื่อเสียงขนาดไหน หมดปัญหาเรื่องการโดนโกง หรือ โดนหลอก ทำให้คลายความกังวลใจ ของนักพนันมือใหม่ ที่ยังไม่มั่นใจ ในเว็บคาสิโนออนไลน์ ได้เป็นอย่างดี และ ที่สำคัญ การ ฝาก-ถอน ด้วยช่องทางนี้ จะไม่ผ่านเอเย่นต์ หรือ คนกลาง แต่อย่างใด เพราะฉะนั้น หมดกังวลเรื่อง การโดนโกงไปได้เลย

สล็อต PG คืออะไร ทำไมถึงได้รับความนิยมสูง

คงมีหลายคนที่ยังไม่รู้ และ ยังสงสัยกันอยู่ว่า สล็อต PG คืออะไร สล็อต PG คือค่ายเกมชื่อดัง ที่ได้รับความนิยม เป็นอย่างมาก เรียกได้ว่า ใครที่เล่นเกมสล็อต จะต้องรู้จัก ค่ายนี้ อย่างแน่นอน เพราะ ตัวชูโลง ของค่ายนี้ ก็คือ เกมสล็อต ที่มีมากกว่า 80 เกม ให้เหล่าผู้เล่นเลือกเล่นกันอย่างมากมาย และ ที่สำคัญที่ทำให้คนชื่นชอบมากคือ สล็อต PG จ่ายหนักจ่ายจริง ด้วยเป็นค่ายเกมที่ยิ่งใหญ่อยู่แล้ว ผู้คนที่ไหลเข้าไปเล่น ก็มีอยู่เป็นจำนวนมาก รางวัลจึงเพิ่มมากตามไปด้วย นอกจากนี้สิ่งที่ทำให้คนไทย นิยมค่ายนี้ก็ คือ สล็อต PG รองรับภาษาไทย ทำให้คนที่ไม่ค่อยรู้เรื่อง ก็สามารถหาข้อมูล หรือ วิธีการเล่นต่างๆได้ เพราะในเว็บยังมี บทความให้ เหล่าผู้เล่น หาอ่าน เสพความรู้ หรือ เทคนิค วิธีการเล่น ต่างๆ อยู่มากมาย และ อีกหนึ่งสิ่ง ที่ทำให้ค่ายนี้ ได้รับความนิยม คือ สล็อต PG โบนัสแตกง่าย เรียกได้ว่าใครที่เข้าไปเล่น ล้วนคืนกำไรให้ผู้เล่นกันทั้งนั้น

สล็อต XO แหล่งรวบเกมสล็อตอันดับหนึ่ง

หลายคนที่ชื่นชอบการเล่นเกมสล็อต ก็น่าจะพอรู้ดีอยู่แล้ว ว่า สล็อต XOคือ ผู้ให้บริการเกมสล็อตแบบออนไลน์ เป็นอันดับต้นๆ ของประเทศ ทุกคนต่างชื่นชอบการเล่นเกม กับ ค่ายนี้ เพราะ สล็อต XOแจกหนักแจกจริง ให้กับผู้เล่น แถมยังเป็นค่ายที่ วางใจได้เรื่องของ ความปลอดภัย และยังเอาใจผู้เล่นด้วยการ ให้ผู้เล่นสามารถวางเงินลงทุน เท่าไหร่ก็ได้ ไม่ว่าจะเป็นคนมีงบน้อย หรือ งบมาก ก็สามารถเล่นได้ทั้งนั้น เพราะเว็บเราเป็นเว็บ สล็อต XOฝากถอนไม่มีขั้นต่ำ นอกจากนี้ยังมีเกม ให้ผู้เล่น เลือกเล่นได้อย่างมากมายถึง 200 เกม ทำให้ผู้เล่น ไม่เกิดความจำเจในการเล่น สล็อต XO ยังรองรับการเล่นใน แพลตฟอร์มของโทรศัพท์มือถือ อีกด้วย ทำให้ผู้เล่นเกิดความสะดวกสบาย ในการเล่น มากยิ่งขึ้น เพราะเชื่อว่า ทุกวันนี้ โทรศัพท์ เป็นสิ่งที่ทุกคนต้องมีติดตัว กันตลอดเวลาอยู่แล้ว

สล็อตแตกง่าย ที่ถูกใจนักเล่นพนัน

สล็อตแตกง่ายเล่นเดิมพันออนไลน์ เกมสล็อตแตกง่าย ที่ถูกใจ ในขณะนี้ ด้วยรูปแบบเกม ฟีเจอร์ สัญลักษณ์ โอกาสสร้างกำไร ที่รวมรวมเกม แบบจุใจ มากมาย ที่แตกต่างกันเล่นเกมที่ดูง่าย เล่นง่าย กฎของเกมสล็อต เข้าใจง่าย แม้กระทั้งผู้เล่นมือ ใหม่ก็สามารถศึกษาได้ โดย ง่าย การวางเดิมพัน ต่อรอบการหมุน การพนันให้เหมาะสม กับงบประมาณของคุณ และ ก็หมุนวงล้อเป็นการพนันหนึ่งครั้ง สำหรับ การเล่นเกม เพียงคุณกด sprin วงล้อจะหมุน แล้วก็หยุดอัตโนมัติ หรือกด ฟังชั่นพิเศษ Auto Spin ด้วยก็ได้ โดย ไม่ต้องกดเสมอๆ สล็อตแตกง่ายแจ็คพอตแตกง่ายมาก แจ็คพอตแตกกันเป็นว่าเล่น และ สล็อตแตกง่ายมีโบนัสฟรี เครดิต อีกมากมาย

สล็อตฟรีสปิน กับรางวัลโบนัสพิเศษต่างๆ

สำหรับ การเล่นสล็อตฟรีสปินออนไลน์ เพียงแค่คุณทำการกดสปริน วงล้อจะหมุนและหยุดลงอัตโนมัติ แต่ถ้าคุณต้องการกดหยุดเองก็ทำได้เช่นกัน ทั้งยังมีการกดแบบ Auto Spin ที่จะทำให้คุณไม่จำเป็นต้องกดด้วยตัวเอง เพราะ ตัวเกมจะทำให้อัตโนมัติด้วยการกดสปินไปเรื่อยๆ จนกว่าคุณจะกดหยุดเอง ถ้าเข้าฟรีสปินตัวเกมจะเข้าสู่ระบบการหมุนเอง สล็อตฟรีสปิน แบบอัตโนมัติ โดยที่คุณไม่เสียเงินเดิมพันเลย แม้แต่บาทเดียว แต่ในบางเกมก็อาจจะให้คุณเป็นผู้เล่นกดหยุดเอง ดังนั้นวิธีการเล่นสล็อตฟรีสปินเข้าใจง่าย อย่างมาก อัตราการจ่ายเงินของเกมสล็อต จะมีการจ่ายแบบตัวคูณรางวัล, จ่ายตามเส้น และจ่ายตามรางวัลโบนัสพิเศษต่างๆ แต่จะขึ้นอยู่กับตัวเกม และ วงเงินเดิมพันที่คุณเลือกในการสปิน จึงควรเข้าสู่การตั้งค่าเพื่อดูสัญลักษณ์การถูกรางวัล เพื่อที่คุณจะได้รู้ว่าเกมสล็อตนั้นคุ้มค่า

Pg slot ได้รับความนิยมมากที่สุด

Pg slotสร้างรายได้ คุณต้อง มุ่งเน้น ไปที่รางวัล คุณต้องผลัก และ หมุนด้วยมือ ของคุณ เพียง เพราะคุณ มีแนวโน้ม ที่จะชนะการใช้ สปินอัตโนมัติ และ ถ้าหมุนหนึ่งครั้ง ให้รอสักครู่ อย่ารีบกดดัน จังหวะ ของการหมุนเป็น สิ่งสำคัญ ในเกมออนไลน์ แบบผู้เล่น หลายคนที่ เล่น Pg slot ออนไลน์ การกำหนด เวลาของตนเอง เป็นสิ่งสำคัญ คุณมีแนวโน้มที่จะได้รับโบนัสแจ็คพอตมากที่สุด เกมสล็อตมีจุดเด่นที่ภาพสวยคมชัด กราฟิกระดับโลก เล่นได้ทั้งในคอมและมือถือ รองรับทุกแพลตฟอร์ม เปิดให้บริการตลอด 24 ชั่วโมง พร้อมระบบ Pg slot ฝาก ถอน แบบอัตโนมัติ ที่รวดเร็วและดีที่สุด คุณภาพระดับพรีเมี่ยม เป็นเกมสล็อตที่ได้รับความนิยมมากที่สุดในตอนนี้ปี 2021 เกม Pg slot ฟีเจอร์ที่หลากหลายไม่เหมือนใคร ง่ายต่อการได้รับแจ็คพอตแตกหรือรางวัลใหญ่

เว็บสล็อตแตกง่าย จ่ายจริงไม่มีข้อจำกัด

หากให้พูดถึง เว็บสล็อตในปัจจุบัน ที่ถูกพูดถึงมากที่สุด คงจะหนีไม่พ้น เว็บสล็อตของทางเราอย่างแน่นอน เพราะเว็บสล็อตของเรานั้น การันตีเรื่องของรางวัล และ โบนัส ที่แจกให้เหล่า ผู้เล่นอย่างไม่อั้น เรียกได้ว่า เป็น เว็บสล็อตแตกง่าย ได้เงินจริง อย่างแน่นอน และ เพื่อให้ผู้เล่นรู้สึกเพลินเพลินในการเล่น เว็บสล็อตของทางเรา ได้จัดเตรียมเกมสล็อต มามากกว่า 200 เกม เพื่อให้ผู้เล่นได้เลือกเล่น กันได้อย่างหลากหลาย เพราะเว็บของเราเป็น เว็บสล็อตแตกง่ายแถมเกมเยอะ ทำให้ผู้เล่น รู้สึกไม่เบื่อหน่ายในการเล่น นอกจากนี้เว็บของเรายังการันตีเรื่องความโปร่งใส ในการ ฝาก-ถอน เพราะเว็บของเรา เป็น เว็บสล็อตแตกง่ายจ่ายจริงไม่ผ่านเอเย่นต์ จึงทำให้ผู้เล่นวางใจได้เรื่องการฝากเงินในเว็บเรา หมดกังวลเรื่องการถูกฉ่อโกงเงินฝาก หรือ เงินถอน ไปได้เลย

Slotxo คืออะไร

Slotxo คืออะไร หลายคนอาจจะยังไม่รู้จัก หรือ ยังไม่คุ้นชิน กับคำๆนี้ แต่เชื่อว่า นักพนันออนไลน์หลายๆคน ต้องรู้จักเป็นอย่างดีแน่นอน โดยเฉพาะกับ ผู้เล่นที่ชอบเล่น เกมสล็อตออนไลน์ เพราะเว็บไซต์นี้ เป็นเว็บไซต์ Slotxo ที่ดีที่สุด ไม่ว่าจะเป็น เรื่องของการบริการ บอกได้เลยว่า ค่ายนี้อำนวยความสะดวกให้กับผู้เล่นเป็นอย่างมาก ทั้งเรื่องของการฝาก-ถอน ก็ทำออกมาได้เป็นอย่างดี ทำให้ผู้เล่นสามารถไว้วางใจ ในการฝาก-ถอน ไปได้เลย เพราะ เป็นเว็บไซต์ Slotxo ฝาก-ถอนฟรีไม่ผ่านเอเย่นต์ นอกจากนี้ Slotxo ยังเป็นค่ายเกม ที่เอาใจคนไทยด้วยการ รองรับภาษาไทย ซึ่งทำให้ผู้เล่น เล่นง่ายมากยิ่งขึ้น และ ยังสามารถ ดาวน์โหลด เป็นแอปพลิเคชั่น ในโทรศัพท์มือถือ เอาไว้เล่นได้อีกด้วย ไม่จำเป็นต้องไปเล่นในเว็บไซต์ แค่เปิดแอปพลิเคชั่น Slotxo ขึ้นมาก็สามารเล่นได้เลย

Slot แหล่งเงินนักพนันออนไลน์

ในช่วงเศรษฐกิจสมัยนี้ การที่จะหาเงินครั้งละมากๆ ภายในเวลาไม่นานนั้นเป็นเรื่องที่ยากและลำบากมากในช่วงวิกฤติแบบนี้ แต่มันเป็นเรื่องง่ายมากในการเล่น Slot พารวย อีกหนึ่งช่องทางในการสร้างผลกำไร จากการลงทุนของเหล่านักพนันออนไลน์ ทั่วทุกประเทศ และนักพนันบางคนยึดการเล่น Slot เป็นอาชีพ ในการหาเงินเพื่อดำเนินธุรกิจต่อ สล็อตออนไลน์นั้นมีเกมหลากหลาย ให้นักพนันออนไลน์ทุกคนได้เลือกเล่นตามต้องการ อาทิเช่น สล็อตแบบคลาสสิก คาสิโนออนไลน์ต่างๆ บาคาร่าออนไลน์ และการเล่น Slot Online ยังมีแอดมินคอยอำนวยความสะดวกให้นักพนันออนไลน์ในการเล่นทุกครั้ง เช่น บริการฝาก-ถอนเงินออนไลน์ การให้คำปรึกษาในการเล่นสล็อต การแนะนำเกมสล็อตต่างๆให้นักพนันหน้าใหม่ และ ยังคอยให้บริการนักพนันตลอด 24 ชั่วโมง จึงไม่แปลกใจเลยว่าทำไม เว็บไซต์ของเราจึงได้รับความนิยม และ ชื่นชอบของเหล่านักพนันออนไลน์ มากหน้าหลายตา

Slot online ยิ่งเล่นยิ่งรวย

Slot online เกมการพนันออนไลน์ ที่ได้รับความนิยม เป็นอันดับต้นๆ ด้วยวิธีการเล่นที่แสนง่าย และ เงินรางวัลที่มีให้กับผู้เล่น อย่างไม่ขาดสาย ทำให้ผู้เล่นต่างติดใจเกม Slot online เป็นจำนวนมาก นอกจากนี้เกมสล็อตออนไลน์ ยังมีข้อดีอีกหลายอย่าง ที่ทำให้เกม Slot online ครองใจ เหล่านักพนัน ไม่ว่าจะเป็นหน้าเก่า หรือ หน้าใหม่ ที่สำคัญ เรื่องของระบบ การฝาก-ถอน ที่รวดเร็ว และ ไม่ผ่านคนกลาง เพราะว่าเราเป็น Slot onlineเว็บตรง จึงหมดกังวลไปได้เลยว่า จะถูกฉ่อโกงเรื่อง เงินรางวัลที่ได้ เว็บของเรานั้น มีความน่าเชื่อถือสูง และ ฐานผู้เล่น ที่มีอยู่จำนวนมาก และ เว็บของเรา ยังแจกโบนัส หรือ ของรางวัล ให้กับเหล่าผู้เล่น อย่างต่อเนื่อง เพียง เข้ามาเล่น ก็มีโอกาสรับรางวัลได้เเล้ว นอกจากจะแจกของรางวัลเยอะแล้ว เว็บของเรา ยังมีเกมสล็อต ให้ผู้เล่น เลือกเล่นมากกว่า 200 เกม เพื่อไม่ให้ผู้เล่น รู้สึกจำเจในการเล่นเกมอีกด้วย

สล็อตออนไลน์ คืออะไร? เล่นง่ายจริงไหม?

สล็อตออนไลน์ หลายคนสงสัยว่ามันคืออะไร และเล่นง่ายจริงหรือไม่ เชื่อได้เลยว่าเหล่านักพนันออนไลน์หลายๆคนต้องเคยเล่นเกมส์สล็อตออนไลน์ เพราะว่า สล็อตออนไลน์เล่นง่ายจ่ายจริง เนื่องจากเป็นเกมที่กำลังฮิตในหมู่นักพนันอย่างมากในยุคนี้ เป็นเกมส์ที่มีรูปแบบการเล่นที่ง่ายกว่าการพนันชนิดอื่น มีเงินรางวัลตั้งแต่เล็กไปถึง แจคพ็อตใหญ่เลยทีเดียว สล็อตออนไลน์เป็นที่นิยม นอกจากเล่นง่ายแล้วยังได้เงินจริงอีกด้วย นักพนันออนไลน์หลายคนสร้างรายได้จาการเล่น สล็อตออนไลน์เป็นอาชีพ เพราะฉะนั้นนักพนันจึงต้องมีเทคนิคการเล่นสล็อต หรือสูตรในการเล่นสล็อต เพื่อให้ได้เงินรางวัลให้มากที่สุดในแต่ละรอบ และ เสียเงินลงทุนให้น้อยที่สุด นี่คือสิ่งที่นักพนันออนไลน์หลายๆคนรู้ดีอยู่แล้วว่า การพนันออนไลน์คือการลงทุน และ เดิมพันด้วยความเสี่ยง ดังนั้นเราควรศึกษาวิธีการเล่น ทริค และ เลือกเว็บสล็อตที่มีความน่าเชื่อถือที่สุด

เทคนิคสล็อตเล่นยังไงให้รวย?

ในปัจจุบันนี้สล็อตออนไลน์เป็นที่นิยมเป็นอย่างมาก และ นักพนันออนไลน์หลากหลายเชื้อชาติ ซึ่งในการเล่นสล็อตออนไลน์นั้น นักพนันแต่ละคนล้วนจะมีแนวทางในการเล่น หรือที่หลายคนนั้นเรียกกันว่า เทคนิคสล็อตออนไลน์ ซึ่งเป็นเคล็ดลับที่จะทำให้มีอัตราได้แจ็คพอตใหญ่ค่อนข้างสูงกว่าการเล่นแบบธรรมดาทั่วไป ตัวอย่างเช่น การวางแผนในการเล่นสล็อตของตัวเอง บริหารระยะเวลาในการเล่น นั้นเป็นการใช้ เทคนิคสล็อตออนไลน์อย่างมีสติ และกฏเหล็กของการเล่นสล็อตออนไลน์ที่เหล่านักพนันทุกคนจะต้องคำนึงถึง ก็คือ อย่าโลภมากเกินไป มีเหตุผล และต้องอยู่กับความเป็นจริง ทุกอย่างที่พูดไปล้วนเป็น เทคนิคสล็อตออนไลน์เล่นแล้วรวย แต่อย่างไรเสีย ขึ้นชื่อว่าการพนัน มันคือการลงทุนด้วยความเสี่ยงสูงอยู่แล้ว เพราะฉะนั้นผู้เล่น ที่อยู่ในวงการพนันออนไลน์หลายๆคน จะต้องเล่นอย่างมีสติ และ ไม่ติดการพนันมากจนเกินไป

เกมสล็อต คืออะไร ทำไมจึงเป็นที่นิยม?

หลายๆคนคงเคยได้ยินคำว่า เกมสล็อตเล่นแล้วรวย กันอยู่แล้วใช่ไหมคะ เป็นการพนันรูปแบบหนึ่งที่มีลักษณะเป็นตู้สุ่มเสี่ยงโชค ออกรางวัลเล็ก ไปจนถึงรางวัลแจคพ็อตใหญ่สูงสุด เล่นง่าย กว่าเกมออนไลน์อื่นๆ ได้เงินง่ายและได้เงินจริง นักพนันมากมายสามารถสร้างรายได้จาการเล่นสล็อต ภายในเวลา ไม่ถึง 3 ชั่วโมง สร้างเงินได้ถึงหลักหมื่นเลยทีเดียว และตอนนี้ เกมสล็อตออนไลน์ ได้ที่เป็นที่นิยมในเหล่านักพนันออนไลน์หลากหลายสันชาติ เนื่องจากเล่นง่าย มีความคล่องตัวในการเล่น และไม่ต้องพึ่งเทคนิคมากมายในการเล่น ลงทุนน้อย แต่ได้ผลกำไรที่คุ้มหลายเท่าตัว เกมสล็อตที่น่าเชื่อถือ ก็เป็นสิ่งสำคัญมากในการเล่นสล็อต เราต้องเลือกเว็บสล็อตที่มีผู้เล่นเยอะ เพราะอาจจะมีความน่าเชื่อถือ ที่เป็นที่นิยมในการเล่น มีฐานนักพนันที่ดี คงที่ บ่งบอกได้ว่าเว็บสล็อตเว็บนี้ไม่โกง แต่อย่างไรก็ตาม การเล่นพนันก็ต้องมีความระมัดระวังและเตือนตัวเองอย่างสม่ำเสมอ

เกมสล็อตออนไลน์ เล่นง่าย จ่ายไม่อั้น

เหล่านักพนันทุกคนล้วนจะรู้จักการเล่น เกมสล็อตออนไลน์พารวย กันดีอยู่แล้วใช่ไหม เพราะว่ามันเป็นรูปแบบการพนันที่เล่นง่าย เข้าใจง่าย และ ไม่ซับซ้อน นักพนันส่วนใหญ่นิยมเล่นเพราะว่าไม่ยุ่งยาก และ มีแนวทางในการเล่นที่ไม่ยากมากนักที่เพิ่มอัตราแจ็คพอตให้สูงขึ้น เล่น เกมสล็อตออนไลน์แล้วรวย การเล่นพนันออนไลน์หลายคนที่เข้ามาในวงการพนัน ทุกคนล้วนต้องการที่จะรวยอยู่แล้ว สล็อตออนไลน์จึงเป็นตัวเลือกที่ดี และ ได้เงินง่ายที่สุดในช่วงเศรษฐกิจแบบนี้ และการ เล่นเกมสล็อตออนไลน์ ในตอนนี้สามารถเล่นได้อย่างง่ายดาย มีทั้งรูปแบบเว็บไซต์และแอปพลิเคชั่น ที่ให้เหล่านักพนันออนไลน์ได้เลือกช่องทางในการเล่นตามใจชอบ รวมถึงระบบฝาก-ถอน เงินออนไลน์ที่มีแอดมินคอยให้บริการนักพนันออนไลน์ตลอด 24 ชั่วโมง ทำให้มั่นใจได้ว่านักพนันจะได้รับเงินรางวัลจากการเล่นสล็อตอย่างแน่นอน

บทความ Ipro168

การแทงบอลในทุกๆวันนี้ มีให้ท่านได้เลือกเล่นกันแบบสบายๆ ง่ายๆ ด้วยการแทงบอลออนไลน์ ซึ่งนักพนันบอลสามารถเข้าร่วมเล่น เข้าถึงผ่านอินเตอร์เนต โดยเปิดผ่านมือถือหรือคอมพิวเตอร์ ซึ่งสามารถเข้าถึงได้ตลอด 24 ชั่วโมง ถ้าพูดถึงการ แทงบอล แล้วคนที่คิดจะเล่นก้ต้องมีความรู้ ความเข้าใจอย่างลึกเกี่ยวกับ แทงบอลออนไลน์ ซึ้งเกี่ยวกับการแทงบอลพอสมควร เพื่อจะได้ไม่เสียเงินเดิมพันไปแบบเปล่าประโยชน์ นักแทงบอลชั้นเซียนหลายๆคนต่างก็มีกลเม็ดเคล็ดลับในการหารายได้จากแทงบอลที่ไม่ซ้ำกัน

ข่าวกีฬา Ipro168

สล๊อตแตกดีมาก

ของฟรีมีอยู่จริง

แอดมิน แจกจริง ตอบไว ดูแลดีสุดๆ

โห แจกจริงหรือนี่ นึกว่าพูดเล่น ได้จริงด้วย

Very Good

| เขียนรีวิว | |

1 2 3 4 5 | |

| ส่งข้อความ ยกเลิก | |

สล๊อตแตกดีมาก

ของฟรีมีอยู่จริง

แอดมิน แจกจริง ตอบไว ดูแลดีสุดๆ

โห แจกจริงหรือนี่ นึกว่าพูดเล่น ได้จริงด้วย

Very Good

ดีมากค่ะลองแล้ว

1 บาทก็เล่นได้ ดีจริง

24 ชม.

24 ชม.